You usually only need to know enough to hire and manage people who run those functions. The many years you spent in medical school were highly effective at preparing you to assist your patients. Unfortunately, they probably didn’t do as good a job of teaching you how to be a business owner.

- Conducting regular financial audits to ensure accuracy and compliance is fundamental in medical accounting.

- Our services include tax preparation and planning for medical practices and individual doctors.

- As a result, healthcare professionals are often unprepared to manage their company’s accounting and tax responsibilities.

- Physicians usually aren’t accounting experts, and it’s easy to make a mess of your books and overlook tax planning strategies that can save you money.

- Our expert team ensures precise financial management, from managing revenue to tracking expenses, to meet the unique needs of your medical practice.

They must also maintain compliance with Generally Accepted Accounting Principles (GAAP). Practices with more complicated revenue cycles, including dealing with insurance claims and varying payment schedules, might find accrual accounting more reflective of their financial status. Make sure you have a separate business bank account and business credit card for the practice, and keep all business and personal expenses separate. But now, as the owner of a medical practice, it’s one of many business functions you need to figure out. In addition to these aspects of GAAP that health care accountants follow, there are numerous healthcare-specific concepts that apply as well.

Neglecting Financial Analysis

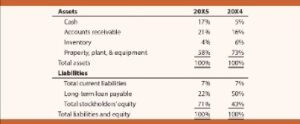

And with their busy schedules, few medical professionals have the time to dedicate to thorough financial planning. A balance sheet is one of the key financial statements, providing an overview of a health care practice’s financial position. The balance sheet offers preparing an adjusted trial balance insight into whether the organization can meet its obligations. However, if they’ve never worked with a busy medical practice before, they may not be able to develop effective medical practice accounting solutions.

We Provide

You don’t just need to account for patient payments—you also need to deal with insurance companies and government-backed programs like Medicare and Medicaid. We are extremely pleased with the exceptional hospital billing services provided by Invensis. Their expertise and attention to detail in Medicare billing and compliance in medical billing have streamlined our revenue cycle and improved financial performance. Cash accounting, on the other hand, only records revenue quiz and worksheet journal entries and trial balance in accounting and expenses when the transaction has been finalized. It’s a simple, straightforward method, and it can be sufficient in certain industries with less complex accounting requirements.

How to Stay Up-To-Date on Accounting Regulations

We ensure that all your financial transactions are accurately recorded and reported, giving you a clear financial picture. Other reports that must be reviewed on a periodic basis are the accounts receivable aging and accounts payable aging. Knowing that submitted claims are being paid and collected in a timely fashion is vital to your medical practice profitability.

Retirement Planning for Doctors:

While you can pay an accounting firm for help with a lot of this, you can’t give up the financial controls altogether. You need to know enough to understand and assess any management solutions they suggest. For example, an in-house bookkeeper might make sense, but you’re probably better off using an outsourced accounting service for your more sophisticated financial needs. You may still need to acquire a few tools for whatever your PMS can’t help you with, such as accounting and payroll services. Before committing to any products, make sure you’ve chosen ones that can interface with each other seamlessly. Fortunately, modern cloud-based software solutions can automate many of the most time-consuming aspects.

Managerial health care accounting analyzes data to make informed decisions about the practice’s operations. Financial accounting ensures the accuracy of income and expenses, but managerial accounting provides insight into spending. Bench provides clients with a modified form of cash basis accounting by recording transactions when they hit your bank or credit card account. However, we can also make accrual adjustments like what are functional expenses a guide to nonprofit accounting tracking accounts receivable and accounts payable with our specialized accounting add-on.

Medical billing is a crucial part of running a successful medical practice, and it can have costly consequences if you don’t handle it correctly. Since 2000, Invensis has been catering to the diverse outsourcing needs of clients for multiple industries and constantly striving to add value to clients’ businesses. We utilize advanced accounting software and secure systems to ensure the confidentiality and security of your financial information.

Generally Accepted Accounting Principles are accounting standards for preparing financial statements. In the health care industry, GAAP is important, as it provides investors and stakeholders with reliable financial information. Health care accounting is distinct from general accounting and other industry-specific accounting in that it focuses specifically on the financial management of health care organizations and entities. As a healthcare provider, you probably want to focus on serving your patients and spend as little time as possible worrying about the financial health of your business. An efficient accounting system is essential for doing so without harming your practice.