Account reconciliation in QuickBooks is a pivotal task for maintaining accurate and reliable financial records. This guide has walked you through the essential steps of the reconciliation process, from preparing your documents to troubleshooting common issues. When you reconcile, you compare two related accounts make sure everything is accurate and matches. Just like balancing your checkbook, you need to do this review in QuickBooks. You should reconcile your bank and credit card accounts in QuickBooks frequently to make sure they match your real-life bank accounts. In the world of business, financial accuracy is the compass that guides decision-making.

Step 4: Compare your bank statement and QuickBooks

Regular reviews help in detecting potential errors or fraudulent activities, thereby safeguarding the financial integrity of the business. It also streamlines the reconciliation process, free cash receipt templates providing a clear and up-to-date financial overview for informed decision-making. Reviewing transactions in QuickBooks Desktop is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement. Reviewing transactions in QuickBooks Online is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement. This helps to verify the accuracy of the recorded transactions and identify any discrepancies between the company’s books and the actual bank statement. Be careful not to reconcile transactions that are not yet cleared or present on your bank statement.

How to Reconcile in QuickBooks Online?

If there are any discrepancies in the beginning balance, utilize the Locate Discrepancies tool to find and resolve them. If necessary, make adjustments to the opening balance or opt to Undo Last Reconciliation to start anew. Input the Ending Balance from your bank statement and include any service charges and interest details, avoiding duplication of previously entered data in QuickBooks Desktop. In your first reconciliation, ensure that the opening balance in QuickBooks Desktop is in sync with the balance of your real-life bank account as of your chosen start date.

Where to Buy Product to Sell on Amazon: A Guide to Finding Products for an Amazon Store

If you choose to connect your bank and credit cards to your online account, QuickBooks will automatically bring over transactions and also the opening balance for you. Make sure you enter all transactions fdic seeking to transition from quarterly call reports for the bank statement period you plan to reconcile. If there are transactions that haven’t cleared your bank yet and aren’t on your statement, wait to enter them. For reviewing past reconciliations, navigate to the Reports menu and select Reports Center. Choose the account you’ve reconciled and select the type of report you need, whether it’s detailed, summary, or both. Now that we know how to prepare for the reconciliation process let’s begin our guide that will walk you through the steps to efficiently reconcile your accounts in QuickBooks Online (QBO).

If you reconciled a transaction by mistake, here’s how to unreconcile it. If you adjusted a reconciliation by mistake or need to start over, reach out to your accountant. Adjusting transactions in QuickBooks is necessary to rectify any disparities identified during the comparison with the bank statement, ensuring the accurate synchronization of financial records. This phase is crucial as it ensures accuracy and integrity in financial reporting, aiding in identifying any discrepancies or errors that need to be resolved before finalizing the reconciliation process. When handling discrepancies between QuickBooks and your bank statements, start by comparing each transaction in QuickBooks against the bank statements to spot any differences. For accounts connected to online banking, confirm that all transactions are accurately matched and categorized.

If you’re a business owner or an accountant, you’re likely aware of the crucial role that accurate financial records play in the success of your enterprise. In the realm of financial management, reconciling accounts stands as a fundamental task. It ensures the harmony between your recorded transactions and the reality reflected in your bank statements. QuickBooks, a leading accounting software, offers a powerful toolset for precisely this purpose. In this comprehensive guide, we’ll walk you through the step-by-step process of reconciling accounts in QuickBooks, ensuring your financial accuracy and peace of mind.

- Upon confirming the reconciliation, the process concludes, showcasing the financial harmony between the records and the bank statement.

- Balancing accounts might sound like a tedious task, but its significance cannot be overstated.

- Before you start with reconciliation, make sure to back up your company file.

- This crucial process begins with gathering the bank statements and transactions from the relevant accounts.

To access the reconciliation tool in QuickBooks Online, navigate to Settings and then select Reconcile. If you need to make changes after you reconcile, start by reviewing a previous reconciliation report. If you reconciled a transaction by accident, here’s how to unreconcile individual transactions. To correct transactions that have already been reconciled, locate the transaction in question and remove the reconciliation marker, such as a checkmark, to un-reconcile it.

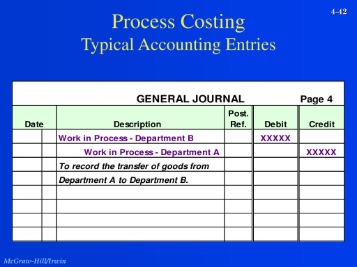

It begins with accessing the reconcile window by navigating to the Banking menu and selecting Reconcile. Then, you’ll need to enter the ending balance from your bank statement and the ending date. Next, review the list of transactions, ensuring that each one matches the transactions on your bank statement. You will then mark each transaction as cleared, either by ticking the boxes or by selecting Reconcile Now to clear all the transactions at once.

This crucial feature can be accessed by navigating to the ‘Banking’ menu and selecting the ‘Reconcile’ option. Once within the reconcile window, users can input the bank statement date, ending balance, and begin matching transactions. The significance of this phase lies in its ability to identify any discrepancies or errors, providing a clear overview opportunities and threats of the company’s financial status.